inheritance tax proposed changes 2021

Ad Enjoy low prices on earths biggest selection of books electronics home apparel more. 20 on assets and property.

Since 2018 estates are only taxed once they exceed 117 million for individuals.

. The STEP Act announced by Senator Van Hollen proposes to eliminate stepped-up basis upon the death of the owner and the 995 Percent Act introduced by Senator Sanders decreases the estate tax exemption down significantly from where it is today. This could result in a significant increase in CGT rates if this recommendation is implemented. As of 2021 117 million per individual and 234 million per couple in assets are exempted from the estate tax effectively protecting most farms from the estate tax.

Browse discover thousands of brands. Ad Inheritance Guidance is Just One of the Benefits of Wealth Planning. In 2022 there is an estate tax exemption of 1206 million meaning you dont pay estate tax unless your estate is worth more than 1206 million.

Estate tax applies at the federal level but very few people actually have to pay it. Meaning estates under 1158 millionpossibly a LOT less than 1158 millioncould be subject to these taxes. Americas small family farms could be destroyed if Congress passes Bidens proposed tax change plan said Grover Norquist President and Founder of Americans for Tax Reform.

The Township tax rate had no increase in 2021 2020 and 2019 after having been lowered in 2018 by 128 percent. In 2021 Iowa passed a bill to begin phasing out its state inheritance tax eliminating. An investor who bought Best Buy BBY in 1990 would have a gain.

The first is the federal estate tax exemption. Proposed changes to Capital Gains Tax. The exemption was 117 million for 2021 Even then youre only taxed for the portion that exceeds the.

Tax Collector Township of Piscataway 455 Hoes Lane Piscataway NJ 08854 732 562-2331 FAX 732 653-7389. Contact our Edison NJ CPA firm at 732-777-1158 or request a consultation online to learn more about our inheritance tax services. Annual exclusion gifts individuals can make certain gifts up to 15000.

Proposed inheritance tax changes would be devastating for family farms study shows. Read customer reviews find best sellers. Only six states actually impose this tax.

For fourth year in a row Piscataway Township has a 128 percent lower municipal tax rate. Facing down an uncertain election outcome and the possibility of tax reform in 2021 many families started transferring substantial amounts of wealth last year making large gifts to take advantage of the historically high gift and. Targeted at multimillionaires and billionaires this proposal imposes a new death tax on many families with long term investments.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. We offer a free initial consultation to individuals and businesses. President Bidens proposal for a new death tax to help pay for his 35 trillion social welfare expansion is hitting resistance from members of Congress including a top farm state Democrat who.

Recently the Agricultural and Food Policy Center at Texas AM University developed a study showing. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Click below to download any checklist.

Please understand though that other governing authorities such as Middlesex County and the school board determine their own tax rates and budgets. He wants to expand the building to 7500 square feet in a neighborhood of. The limit for chargeable trust property is increased from 150000 to 250000.

The owner of 603 wants to make major changes to the house for a five-doctor office building with underground parking. Tucked away in Bidens American Families Plan is the elimination of a step-up in basis tax benefit on appreciated assets like farms. Gifts and generation skipping transfer tax exemption amounts are indexed for inflation increasing to 117 million in 2021 from 1158 million in 2020.

7 hours agoInheritance tax is a bigger threat to family wealth than ever with receipts hitting an all-time high of 61 billion during the 202122 financial. In addition when a decedent passes farm assets to an heir the heir can take fair. This change may deliver a bill for capital gains taxes at death.

For exempt estates the value limit in relation to the gross. Check out our team of experienced CPAs accountants and financial professionals. Individuals have 120000 additional gift and generation-skipping transfer tax exemptions that can be used this year.

The proposal includes tax exemptions up to 1 million for single heirs and up to 25 million for couples a White House fact sheet. The changes in tax rates could be as follows. The tax rate on the estate of an individual who passes away this year with an estate valued over the 1158 million exemption is also a flat 40.

234 million for married couples at. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. There are signs that the Federal exemption for estate taxes may be lowered in 2021.

10 on assets 18 on property.

Inheritance Tax The Seven Hmrc Exemptions Everyone Needs To Know In 2022 In 2022 Inheritance Tax Tax Mistakes Paying Taxes

From Brother Iprint Scan Sheet Music Scan Music

The Telegraph Tax Guide 2021 Your Complete Guide To The Tax Return For 2020 21 Edition 45 Hardcover Walmart Com In 2022 Tax Guide Tax Return Inheritance Tax

Newsletter 11 12 21 The Housing Market Will Cool Off In 2022 But Not By Much Says Fannie Mae Housing Market Predicti In 2021 Rio Vista Isleton How To Raise Money

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Only State To Inheritance Tax Estate Tax States

Invoice Template Editable Invoice Template Excel Automatic Etsy Invoice Template Bookkeeping Templates Invoicing

Taxtips Ca Manitoba 2021 2022 Personal Income Tax Rates

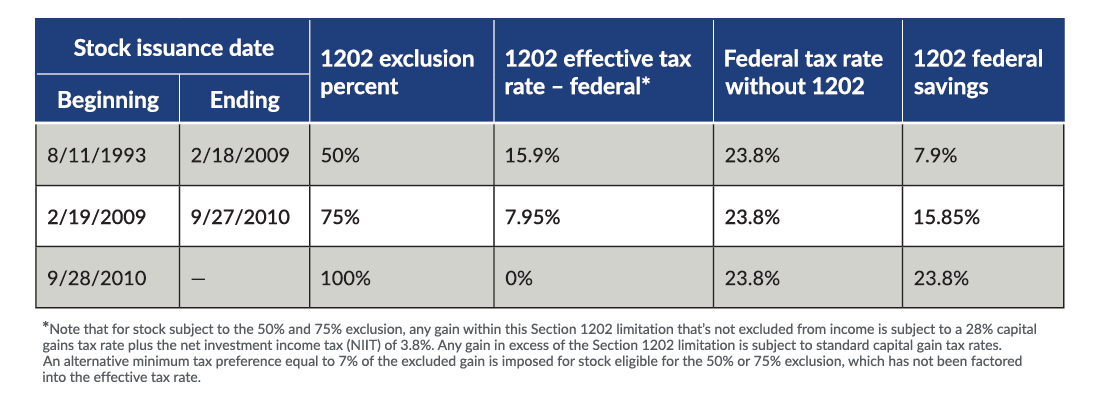

Almost Too Good To Be True The Section 1202 Qualified Small Business Stock Gain Exclusion Our Insights Plante Moran

Last Dates For Filing Gstr 3b Without Late Fee And Interest Last Date Dating Filing

2021 2022 Income Tax Calculator Canada Wowa Ca

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

The Treasury Green Book Of Biden Proposed Tax Changes In 2021 Capital Gain Estate Tax Corporate Tax Rate

Estate Planner Leave A Legacy Not A Ledger Templates For Onenote By Auscomp Com

Pin By Tri City Association Of Realto On Tcar Classes Events Tax Reduction Register Online Learning

Pdffiller On Line Pdf Form Filler Editor Type On Pdf Fill Print Email Fax And Export