san mateo tax collector property tax

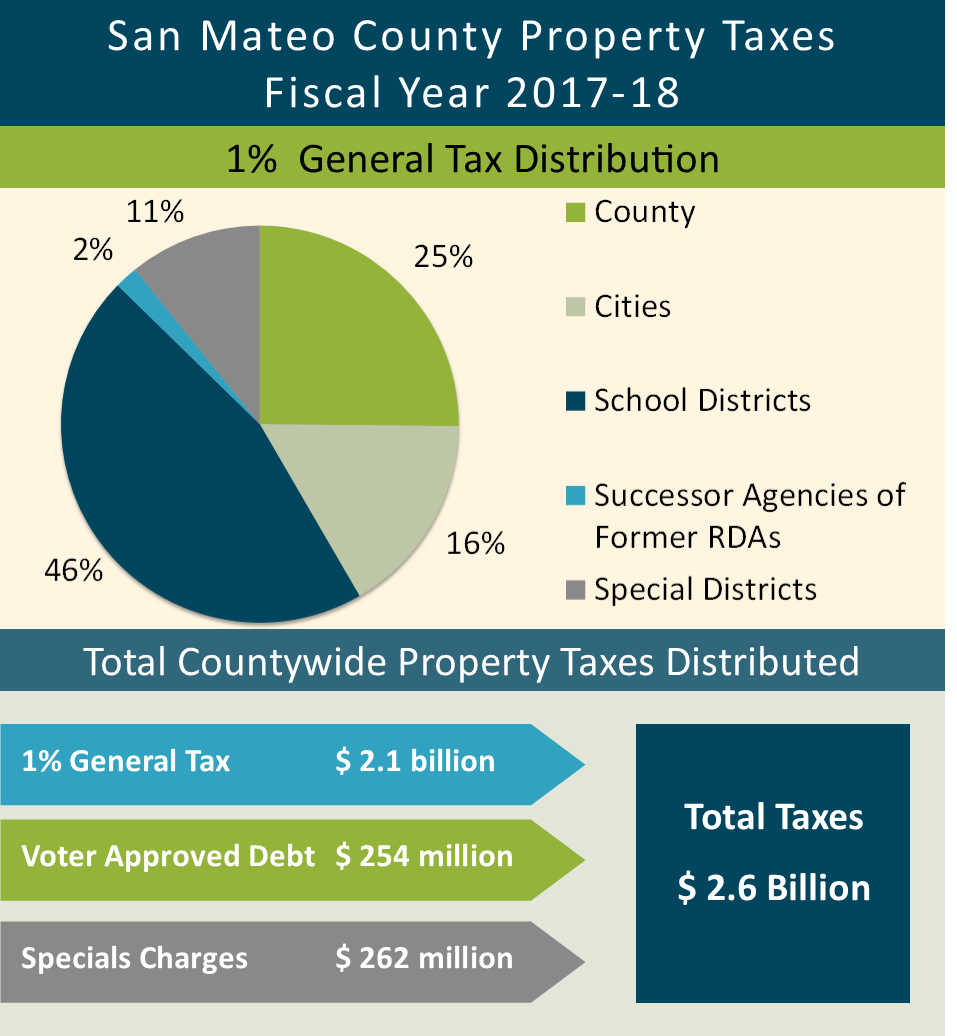

Finally the 1 tax rate is applied to that amount to get your supplemental tax total. San Mateo County collects on average 056 of a propertys.

San Francisco Property Tax 2022 Ultimate Guide To Sf Property Tax Rates Search Payments Due Dates

Electronic payments made online over the phone or in office will incur a service fee as.

. Taxing authority Rate Assessed Exemption Taxable Factor Tax. 555 County Center 1st Floor. County of San Mateos Treasurer-Tax Collector offers a Secured Property Tax Search where you can find your property tax by searching by address or parcel number.

Property Tax Relief Assessment. Over the phone at 866-666-5444. County of Marin Job.

The Property Tax Division manages key aspects of the property tax process including that property taxes payable by each taxpayer are accurately calculated taxes collected are. 1-877-829-4732 Operators do not accept payments email - taxmansdcountycagov. Property Tax Bills and Refunds San.

Secured property taxes are calculated based on real propertys assessed value as determined annually by the Office of the Assessor-Recorder. Property Tax Bill Information and Due Dates. You may also call our office at 909 387-8308.

Payment plans may not be started online. The median property tax in San Mateo County California is 4424 per year for a home worth the median value of 784800. The 20212022 Annual Secured property tax roll is closed.

San Mateo County secured property. View a property tax bill and make property taxes payments including paying online by mail. The San Joaquin County current year property tax roll is available online for inquiry or to make a payment by credit card debit card or E-Check.

You may pay your property tax bills. The amount of taxes due for the current year can be found on the TreasurerTax Collectors web site or contact the Tax Collectors Office at 8662200308. San Mateo County Assessor.

Redwood City California 94063. 650 363 4500 Phone 650 363 1903. Box 7426 San Francisco CA 94120-7426.

Please have your payment postmarked on or before the delinquent date and mail it in or pay by credit card on our phone. Please call 800 952-5661 or email postponementscocagov if you prefer to have an application mailed to you. Countywide Tax Supplemental 100000000.

Community Services Fund Program. Treasurer- Tax Collector San Diego County. 2019 2022 Grant Street Group.

Announcements footer toggle 2019 2022 Grant Street Group. The 2021 2022 Annual Secured property tax roll is closed. Office of the Treasurer Tax Collector PO.

Benefits and Job Assistance.

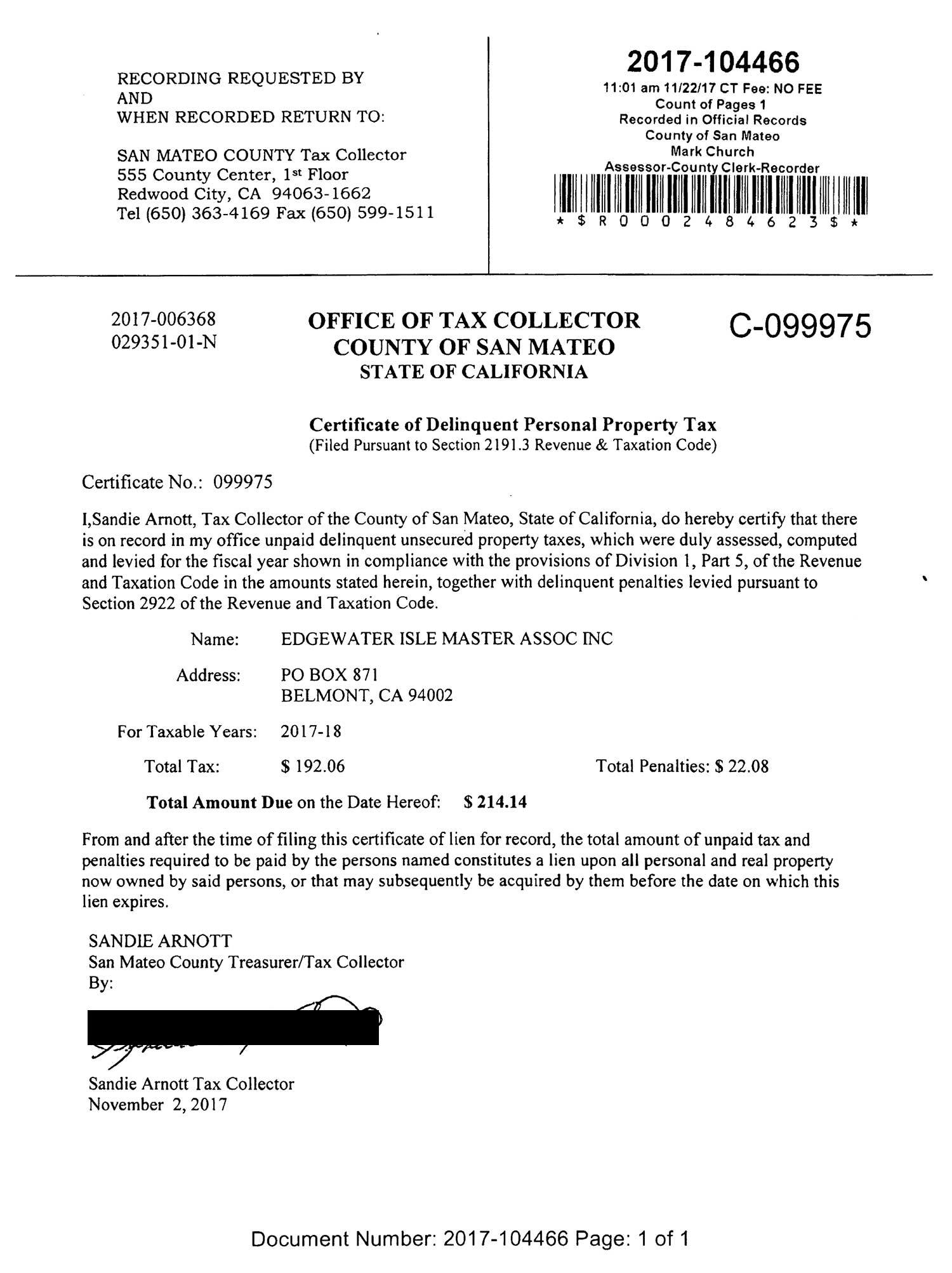

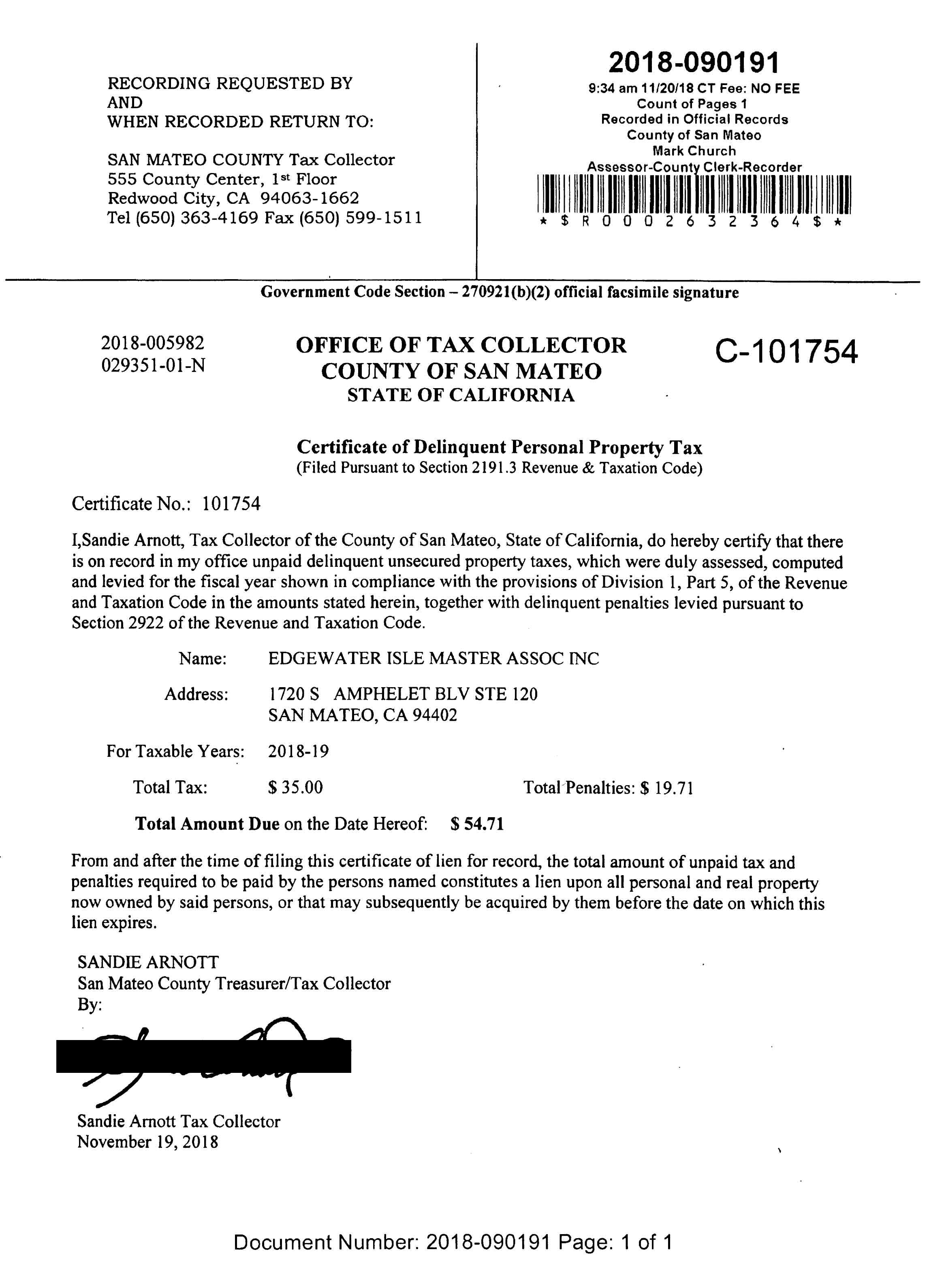

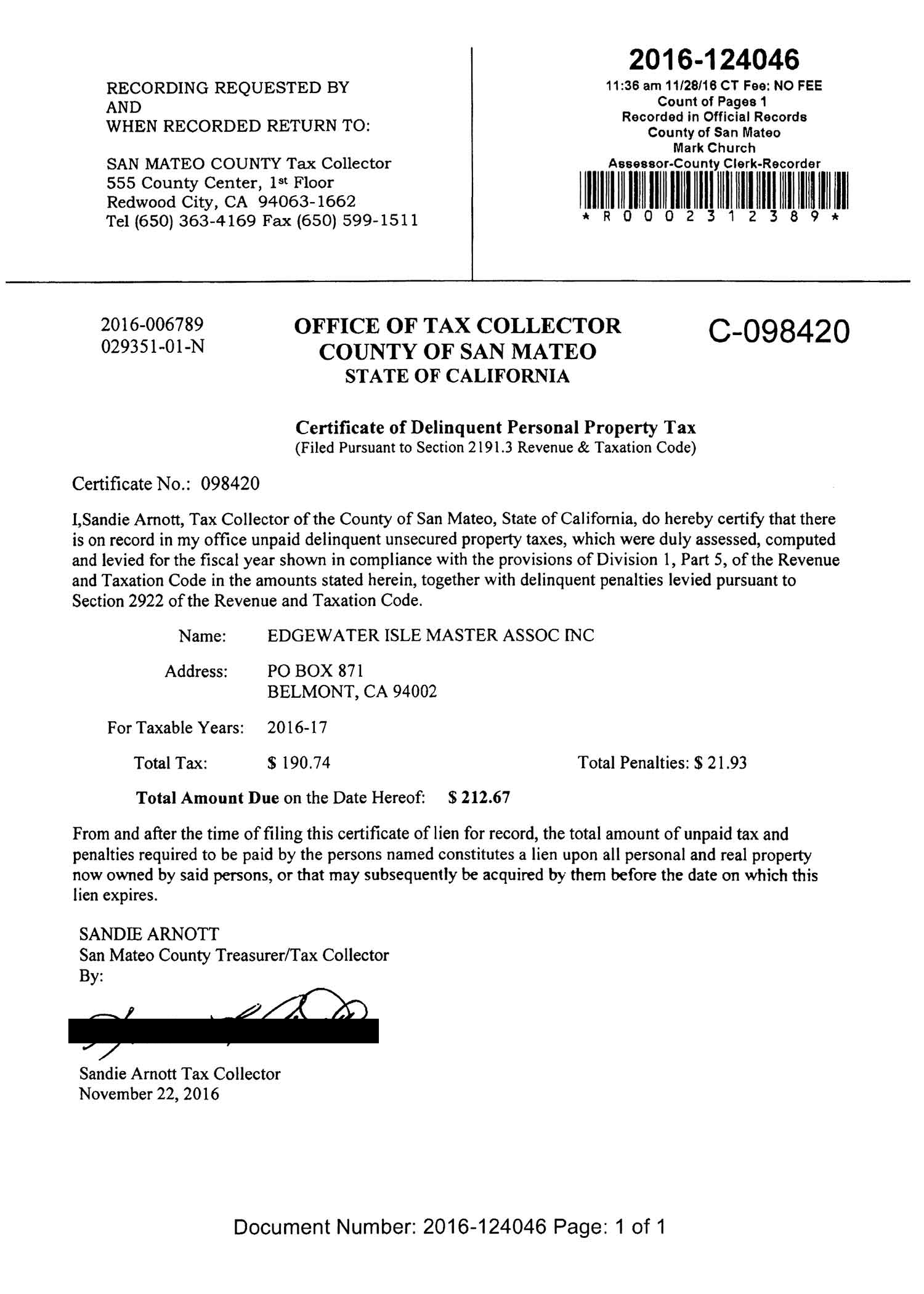

San Mateo County Issues Liens Against Master Association

Interactive Map Compares Californians Property Taxes

Alameda County Tax Collector Announces Property Tax Penalty Waiver Procedure News Pleasantonweekly Com

Sandie Arnott County Of San Mateo Ca

San Mateo County Ca Goes Live With Taxsys Business Wire

Property Tax Supplemental Tax Sakura Realty

San Mateo County Ca Property Tax Search And Records Propertyshark

San Mateo County Ca Goes Live With Taxsys Business Wire

Using The Tax Payment System County Of San Mateo Ca

New Interactive Voice Technology Being Used By Tax Collector S Office

San Mateo County Issues Liens Against Master Association

County Of San Mateo Government Now That The Property Tax Bill Deadline Is Behind Us Did You Know That You Can Find All Of The County S Property Tax Data By

Property Tax Bill Stege Sanitary District

Interactive Map Shows How Much Property Tax Most Californians Pay Compared With Neighbors

County Controller Publishes Property Tax Highlights For Fy 2021 22 County Of San Mateo Ca

San Mateo County Issues Liens Against Master Association

Smc Home County Of San Mateo Ca